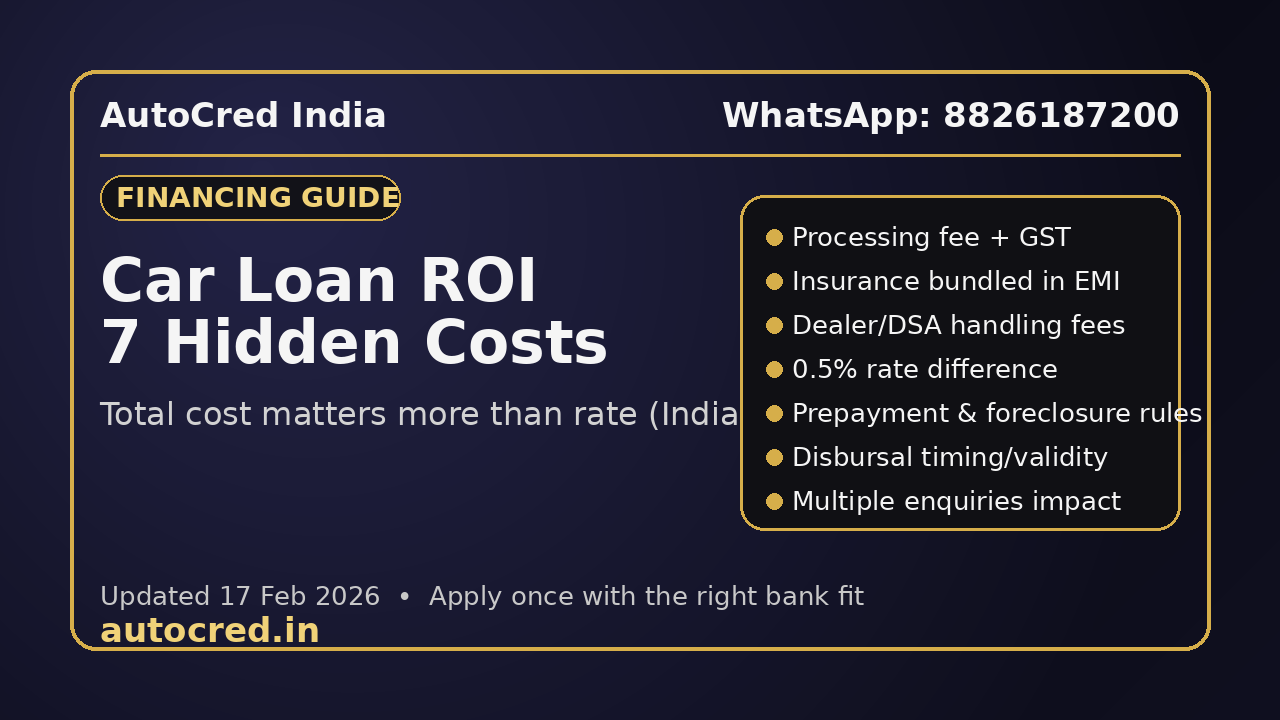

Car Loan ROI: 7 Hidden Costs Buyers Ignore (2026) — Total Cost Ka Sach

Most buyers only compare interest rate (ROI), but the real cost comes from hidden charges like processing fee + GST, insurance bundling, dealer charges, foreclosure rules, and enquiry mistakes. Here’s a simple 7-point checklist to save money. AutoCred India helps you apply with the right bank profile once (Pan-India). WhatsApp: 8826187200

Car Loan ROI: 7 Hidden Costs (2026) — Sirf Interest Rate Mat Dekho

Most people car loan choose karte time sirf ek cheez compare karte hain: ROI (interest rate). But reality ye hai: “Best ROI” ka matlab “cheapest loan” nahi hota.

Aaj main tumhe 7 hidden costs bata raha hoon jo total cost ko badha dete hain — aur isi wajah se buyers baad me kehte hain: “Yaar loan mehenga pad gaya.”

✅ Rule: ROI + Charges + Rules + Timing = Real Cost

- Processing Fee + GST (silent cost) Bank ka processing fee + GST add hoke upfront me bada amount ban jata hai. Tip: ROI thoda sa upar ho, par PF low ho to total cost kabhi-kabhi kam padta hai.

- Insurance “bundled” karke EMI me chipka dena Kai jagah insurance add-ons (zero dep, RTI, engine protect) ko EMI me add kar dete hain. Tip: Insurance separate quote lo. Add-ons lo, par clarity ke saath.

- Dealer / DSA “loan handling” charges Loan approve karwana = service; par charges transparent hone chahiye. Tip: Written breakup lo: PF, insurance, RTO, accessories, handling — sab alag.

- 0.5% ROI difference actually big hota hai 0.5% chhota lagta hai, par 5–7 years me thousands ka difference aata hai. Tip: Same loan amount/tenure pe EMI compare karo, sirf ROI mat dekho.

- Part-payment & foreclosure rules Some banks me part-payment limited hoti hai ya foreclosure charges/conditions hoti hain. Tip: Agar future me prepay plan hai, “prepayment friendly” bank choose karo.

- Disbursal validity & timing Approval ke baad disbursal time limit hota hai. Delay hua to rate/offer change ho sakta hai. Tip: Token dene se pehle disbursal timeline fix karo.

- Multiple enquiries ka damage Har jagah apply karoge to enquiry count badhega → profile risky → ROI worse ya rejection. Golden rule: Apply with the RIGHT bank profile ONCE — not everywhere.

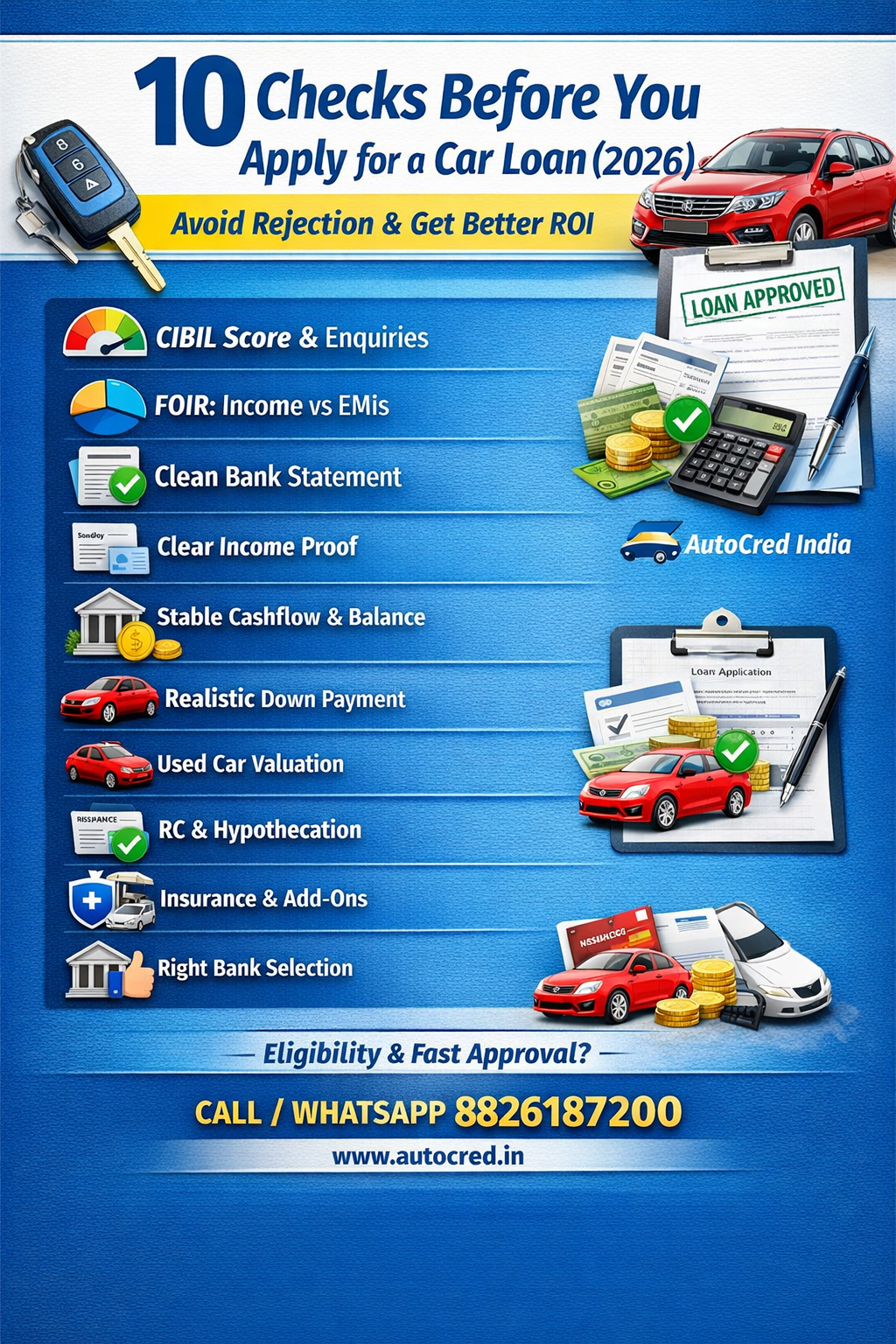

✅ 30-Second Checklist (paste this in your notes) • CIBIL + recent enquiries • FOIR (existing EMIs vs income) • Last 3 months bank statement clean • Processing fee + GST breakup • Insurance breakup (bundled or separate) • Prepayment/foreclosure rules • Disbursal timeline

Agar tum chaho, AutoCred India tumhara quick eligibility + bank fit check karke “best ROI + best rules” wali file ek baar me submit karwa deta hai (Pan-India).

WhatsApp/Call: 8826187200 Email: info@autocred.in

Final line: Car pasand karo — finance smart jagah se karo.