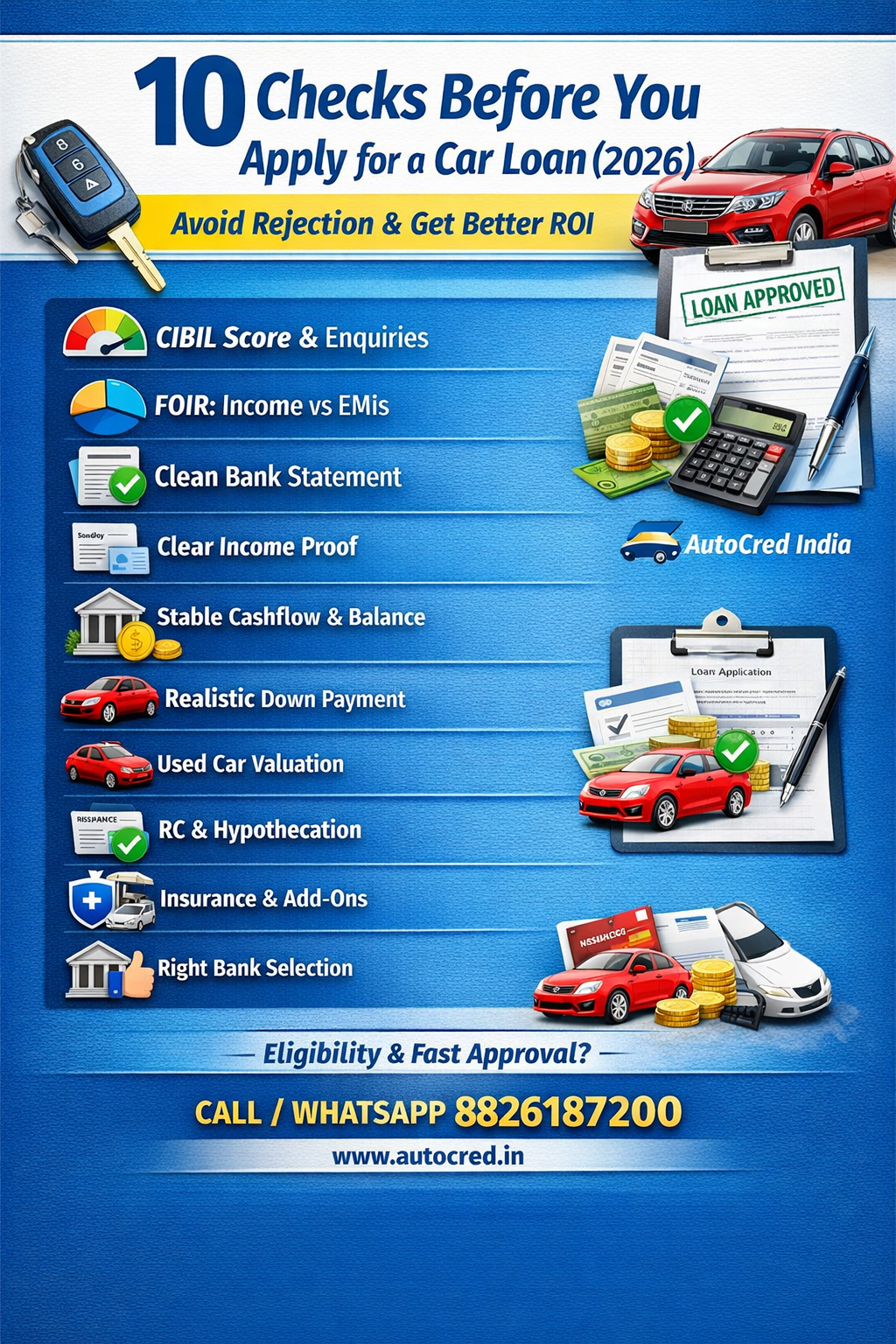

10 Checks Before You Apply for a Car Loan (2026) — Avoid Rejection & Get Better ROI

Before applying for a car loan, follow this 10-point checklist to avoid rejection and secure a better ROI (interest rate): CIBIL & enquiries, FOIR, clean bank statement, income proof, cashflow stability, down payment planning, used car valuation, RC & hypothecation checks, insurance add-ons, and the right bank selection. AutoCred India helps you apply with the right bank profile once (Pan-India). WhatsApp: 8826187200

10 Checks Before You Apply for a Car Loan (2026)

If you’re applying for a car loan, avoid the most common mistake: applying everywhere.

Why it hurts: • Too many enquiries • Your profile looks risky • ROI (interest rate) can go worse • Approval can get delayed or rejected

Golden rule: Apply with the RIGHT bank profile ONCE — not everywhere.

Here’s a simple 10-check checklist (2026):

- CIBIL score + recent enquiries A good score helps, but too many fresh enquiries in 15–30 days can make banks cautious.

- FOIR (Income vs existing EMIs) If your existing EMIs are high vs income, eligibility drops.

- Clean bank statement (last 3 months) EMI/NACH bounces, frequent return entries, penalties = red flag. Clean statement = faster approvals.

- Clear income proof Salary credits / ITR / GST / receipts (as per your profile) must be consistent.

- Stable cashflow & average balance Banks want confidence your EMI will be paid smoothly. Sudden dips look risky.

- Realistic down payment planning Plan for insurance, RTO, accessories, and processing charges—not just car price.

- Used car? Confirm valuation BEFORE token Valuation decides your loan amount. Confirm expectations before paying any token.

- RC / ownership / hypothecation checks Owner count, hypothecation status, pending issues can impact approval.

- Insurance & add-ons (choose smartly) Zero dep, RTI, engine protect can help—pick as per usage, don’t buy blindly.

- Right bank selection (case-fit) Not every bank suits every profile. Right bank fit = better ROI + fewer rejections.

Want a quick eligibility pre-check before you apply? AutoCred India can help you pick the right bank fit and structure your file cleanly for faster approval (Pan-India).

WhatsApp/Call: 8826187200 Email: info@autocred.in

Final line: Choose the car you love — we’ll handle the finance the smart way.