Car Loan for Low CIBIL Score in India – Smart Approval Strategy 2026

Getting a car loan with a low CIBIL score in India may feel difficult, but it is not impossible. Many applicants face rejection because they do not understand how lenders evaluate credit profiles. In this 2026 guide, AutoCred India explains how car loans work for low CIBIL score applicants, what banks check, how to improve approval chances, and smart strategies to reduce interest burden. We also explain how down payment, income proof, and lender selection play an important role. If your CIBIL score is below 700 and you are planning to buy a new or used car, this guide will help you move forward confidently. Car pasand karo, finance ka tension hum sambhal lenge.

Car Loan for Low CIBIL Score in India – Smart Approval Strategy 2026

Many car buyers think that a low CIBIL score means automatic rejection.

This is not always true.

Yes, a low score makes approval slightly difficult, but with the right strategy, car loan approval is possible.

In this guide, AutoCred India explains how you can improve your chances even if your CIBIL score is below 700.

What Is Considered a Low CIBIL Score?

750 and above – Strong profile

700 to 749 – Average

650 to 699 – Moderate risk

Below 650 – High risk

Most banks prefer 750+, but NBFCs and some lenders may consider lower scores depending on profile strength.

Why Car Loans Get Rejected with Low CIBIL

Late credit card payments

Personal loan defaults

High credit utilisation

Multiple loan enquiries

Settlement cases

Lenders see these as risk indicators.

Smart Strategy to Get Car Loan with Low CIBIL

-

Increase Down Payment

Instead of 10%, try 20%–30% down payment.

Higher contribution reduces lender risk.

-

Choose the Right Lender

Banks are strict.

NBFCs may offer flexible options depending on income stability.

-

Show Strong Income Proof

Stable salary account

Last 6 months bank statement

ITR for self-employed

-

Reduce Existing Loan Burden

If possible, close small outstanding loans before applying.

-

Avoid Multiple Applications

Too many enquiries reduce your score further.

Apply smartly with guidance instead of random applications.

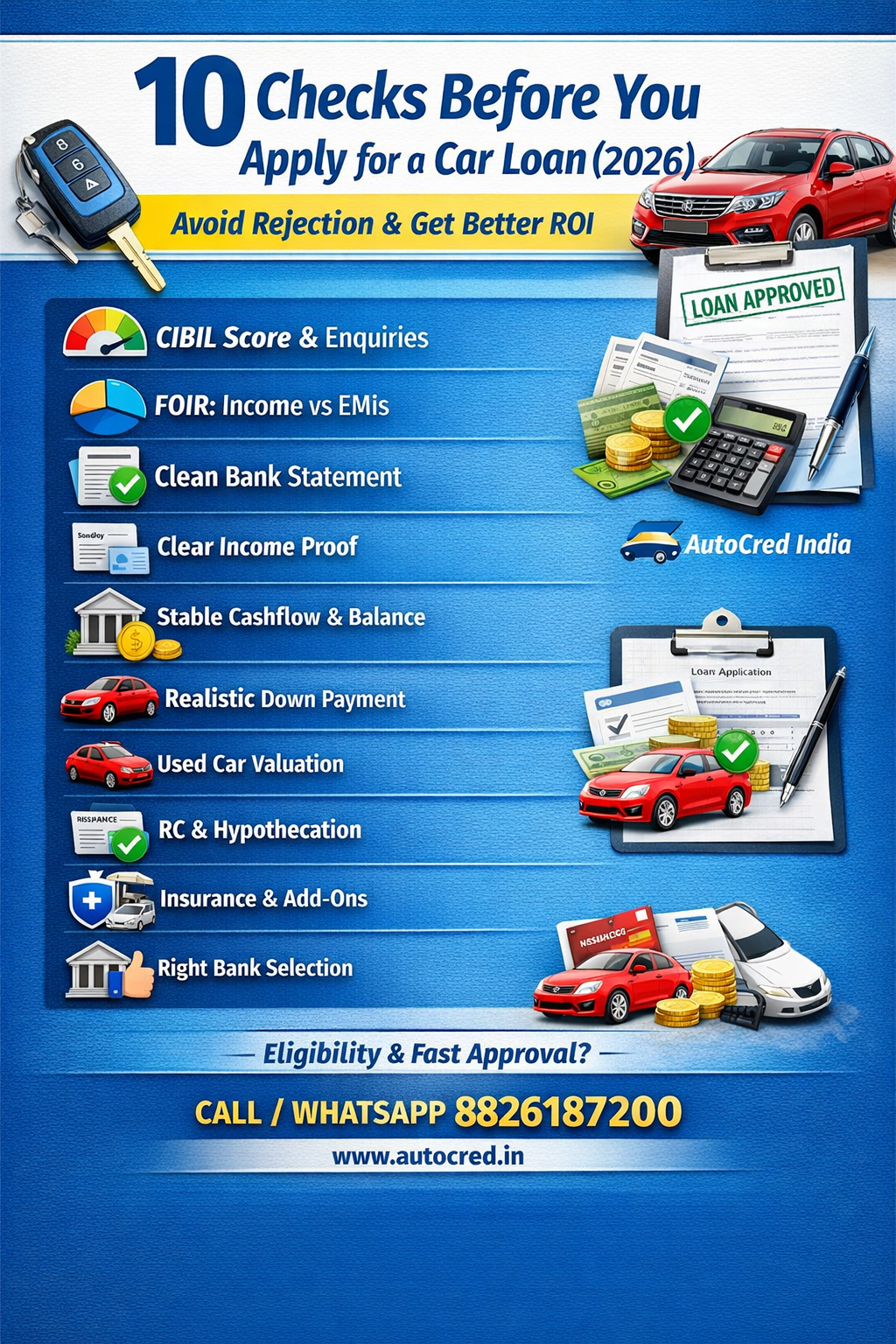

Quick Checklist Before Applying

Check your latest CIBIL report

Clear overdue payments

Maintain salary balance properly

Plan higher down payment

Choose realistic car budget

Consult loan expert before applying

Need profile evaluation before applying?

Call or WhatsApp: 8826187200

Email: info@autocred.in

AutoCred India helps you choose the right lender based on your credit profile.

Car pasand karo, finance ka tension hum sambhal lenge.

New Car vs Used Car – Which Is Easier with Low CIBIL?

Used car loans sometimes have slightly flexible approval criteria because loan amount is lower.

If your CIBIL is very low, starting with a used car may increase approval chances.

However, interest rate may be slightly higher compared to strong credit cases.

How Much Interest Can Increase?

Low CIBIL cases may get interest rates slightly higher than standard profiles.

Instead of focusing only on lowest rate, focus on:

Approval probability

EMI affordability

Total repayment plan

Can You Improve CIBIL Before Applying?

Yes.

Pay all EMIs on time

Reduce credit card usage below 30% limit

Avoid new loan applications

Do not settle loans – try to close properly

Even 2–3 months of discipline can improve score gradually.

Why Proper Guidance Matters

Wrong application strategy can lead to multiple rejections.

Multiple rejections make approval harder later.

That is why expert profile matching is important.

Why Choose AutoCred India?

AutoCred India helps applicants across India who face credit challenges.

We guide you with:

Profile analysis

Right lender selection

Documentation preparation

EMI planning

We focus on realistic solutions without fake promises.

FAQs – Car Loan for Low CIBIL Score

-

Can I get car loan with 650 CIBIL score?

Yes, possible depending on income and down payment. Lender selection is important.

-

Will interest rate be higher for low CIBIL?

Usually yes, because lenders consider it higher risk.

-

Is it better to wait and improve score first?

If possible, improving score before applying can help you get better interest rate and approval chances.

Planning to buy a car but worried about CIBIL?

Call or WhatsApp: 8826187200

Email: info@autocred.in

AutoCred India will guide you step by step.

Car pasand karo, finance ka tension hum sambhal lenge.