Car Loan for Low CIBIL Score in India – Smart Approval Strategy 2026

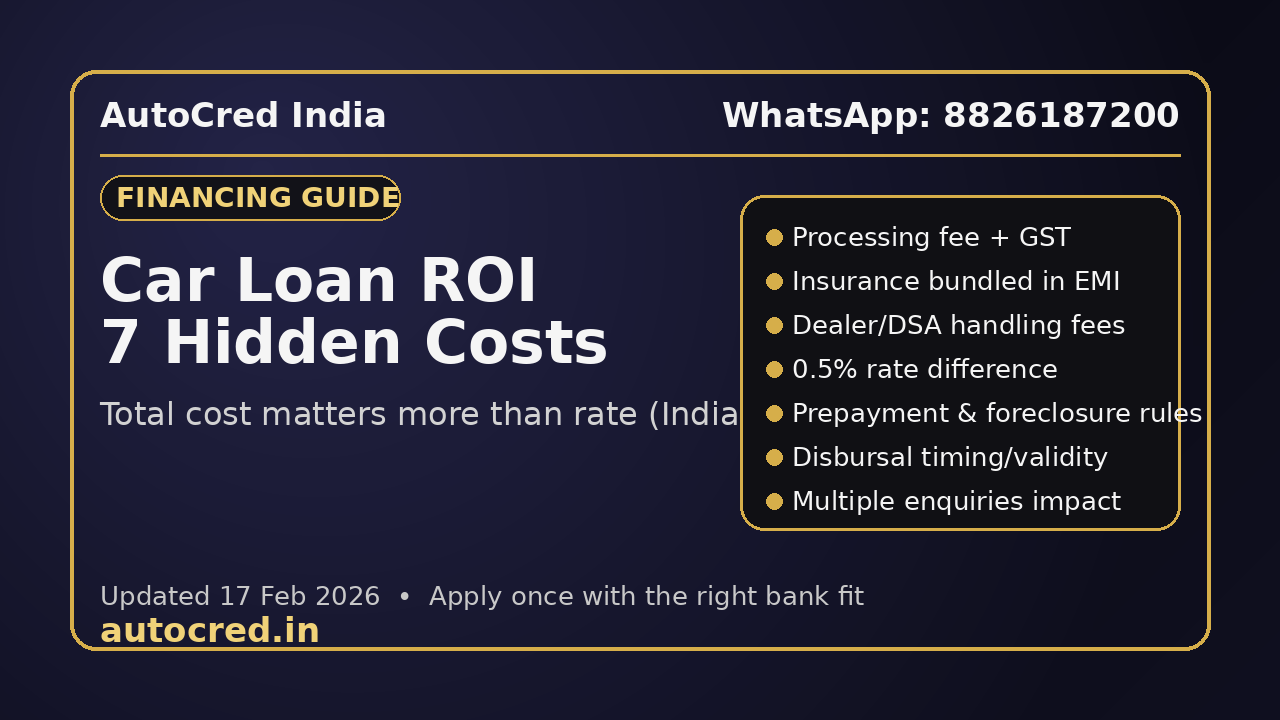

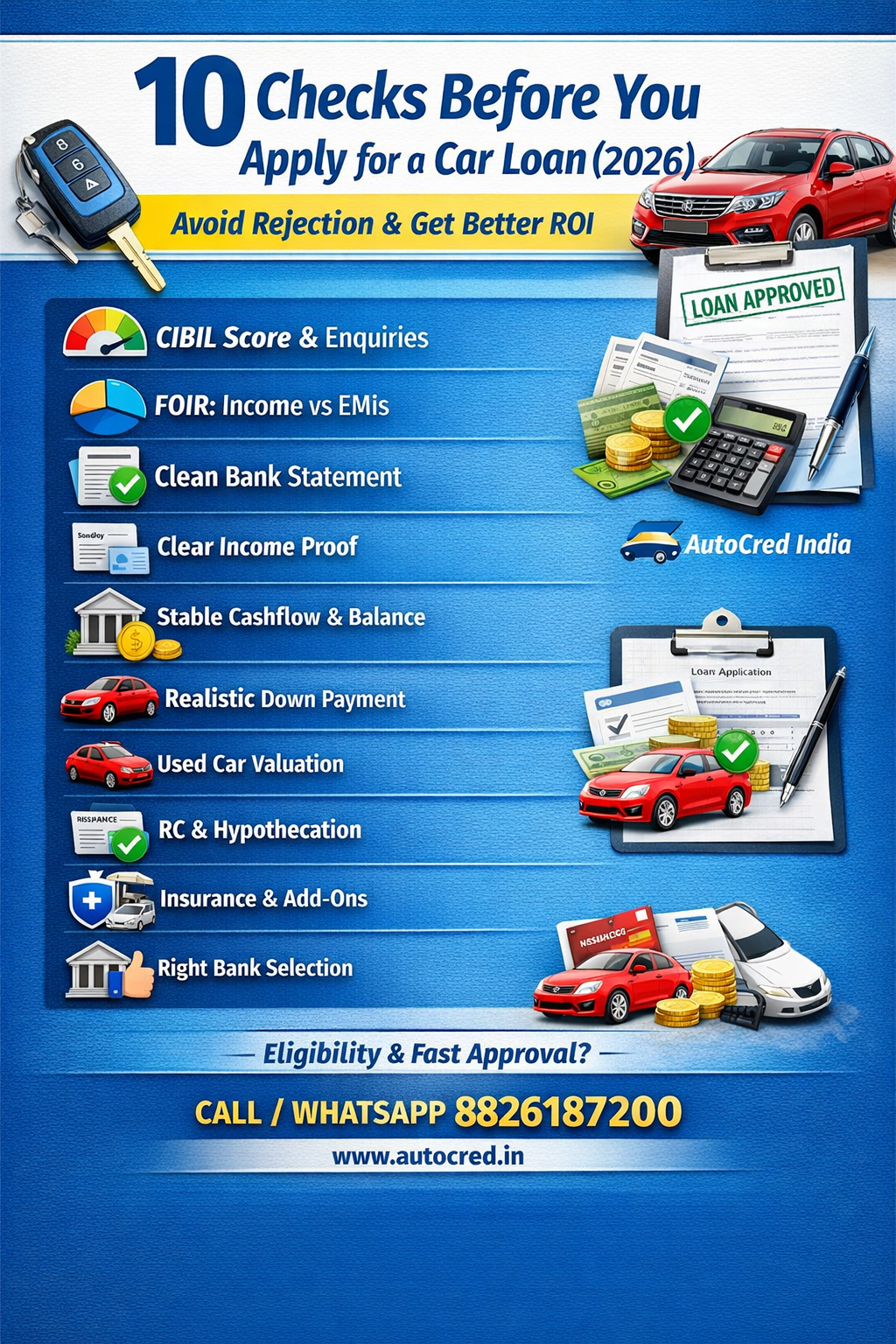

Getting a car loan with a low CIBIL score in India may feel difficult, but it is not impossible. Many applicants face rejection because they do not understand how lenders evaluate credit profiles. In this 2026 guide, AutoCred India explains how car loans work for low CIBIL score applicants, what banks check, how to improve approval chances, and smart strategies to reduce interest burden. We also explain how down payment, income proof, and lender selection play an important role. If your CIBIL score is below 700 and you are planning to buy a new or used car, this guide will help you move forward confidently. Car pasand karo, finance ka tension hum sambhal lenge.

Read more